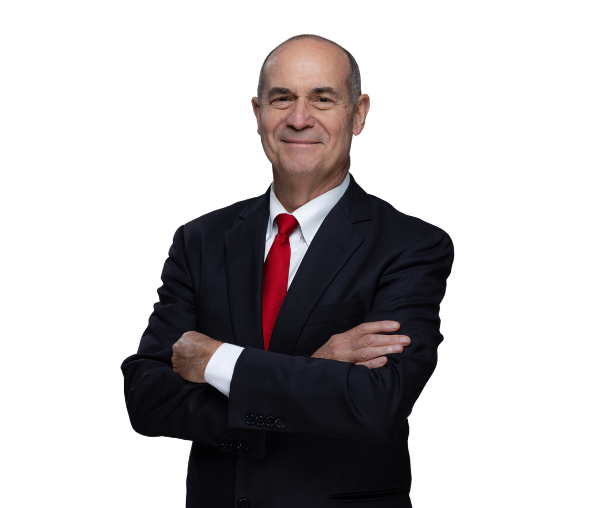

Overview

Dave has more than 40 years of experience counseling clients on all aspects of business law, including the formation, operation, disposition, merger, and acquisition of closely held and family enterprises.

His practice encompasses a wide range of matters, from governance and shareholder disputes to daily operational issues such as contracts, leases, employment agreements, and deferred compensation. Dave supports entrepreneurs with start-up formation, funding, and equity arrangements, and manages the sale and acquisition of businesses and real estate with an emphasis on tax optimization.

Dave also provides comprehensive counsel on estate and gift planning, advanced retirement plan designs, and tax-qualified plan operations. Dave is skilled in succession planning, including buy-sell agreements and employee stock ownership plans, and he handles complex estate planning strategies and represents clients in IRS tax controversies related to retirement plans and estate and gift taxes.

Representative Experience

- Represented selling enterprises in connection with pre-transaction restructuring for preferred tax results and sale of the same.

- Represented corporations with retiring owners to establish ESOPs to purchase retiring owner shares on tax-advantaged basis for both the ESOPs and the retiring owners.

- Represented business enterprises in connection with raising equity capital with preferred and non-preferred equity interests.

- Represented decedents’ estates in IRS audits of estate tax returns.

- Represented fiduciaries in connection with beneficiary fiduciary breach claims.

Education & Admissions

Education

- Case Western Reserve University School of Law, J.D., 1980

- John Carroll University, B.S.B.A., magna cum laude, 1977

Bar and Court Admissions

- State of Ohio

- U.S. District Court, Northern District of Ohio

- U.S. Tax Court

Involvement

Professional Affiliations

- Estate Planning Council of Cleveland, Member (1984 – Present)

- Tax Club of Cleveland, Member (1984 – Present)

- Ohio State Bar Association, Member (1980 – Present)

- Cleveland Metropolitan Bar Association, Member (1980 – Present)

Community Involvement

- Geauga Park District Foundation, Trustee (2000-2006); Secretary (2004 – 2006)

- Troy Township (Geauga County) Board of Zoning Appeals, Member (2006 – 2012, 2024 – Present)

- Chairman (2010 – 2012)

- Geauga County Bluecoats, Inc. (2010 – Present)

- Parkside Church, Member (2000 – Present)

Awards & Honors

- Recognized by Best Lawyers® in the areas of Closely Held Companies and Family Businesses Law, Employee Benefits (ERISA) Law, Tax Law, and Trusts and Estates (2009-Present)

- Recognized on the Ohio Super Lawyers list (2010, 2017 – Present)

- Recognized as Lawyer of the Year in Closely Held Companies and Family Businesses Law in Cleveland by Best Lawyers® (2019)

- Rated as AV Preeminent by Martindale-Hubbell

Publications

- “Transfer restrictions for closely held businesses,” Currents Magazine (November 2021)

- “Ohio’s New LLC Statute Will Become Effective in 2022,” Frantz Ward Client Alert (August 2021)

- “Congress Clarifies the Deductibility of Expenses Paid with Forgiven PPP Loan Proceeds,” Frantz Ward Client Alert (December 2020)

- “Deadline for Rolling Over 2020 RMDs Expires August 31, 2020,” Frantz Ward Client Alert (July 2020)

- “Ohio Income Tax Filing Date Extended to July 15,” Frantz Ward Client Alert (March 2020)

- “The SECURE Act May Have a Material Impact on Your Estate Planning,” Frantz Ward Client Alert (January 2020)

Presentations & Lectures

- “When Closely Held Businesses Are Held Too Closely,” Association of Corporate Counsel, Cleveland, OH (August 2021)

- “Contract Implications in the Age of COVID-19,” Association of Corporate Counsel Webinar (October 2020)

Media Coverage

- Mentioned in, “Lawyers, Firms Receive Recognition,” Cleveland Jewish News (January 2021)

Representative Experience

- Represented selling enterprises in connection with pre-transaction restructuring for preferred tax results and sale of the same.

- Represented corporations with retiring owners to establish ESOPs to purchase retiring owner shares on tax-advantaged basis for both the ESOPs and the retiring owners.

- Represented business enterprises in connection with raising equity capital with preferred and non-preferred equity interests.

- Represented decedents’ estates in IRS audits of estate tax returns.

- Represented fiduciaries in connection with beneficiary fiduciary breach claims.

Education & Admissions

Education

- Case Western Reserve University School of Law, J.D., 1980

- John Carroll University, B.S.B.A., magna cum laude, 1977

Bar and Court Admissions

- State of Ohio

- U.S. District Court, Northern District of Ohio

- U.S. Tax Court

Involvement

Professional Affiliations

- Estate Planning Council of Cleveland, Member (1984 – Present)

- Tax Club of Cleveland, Member (1984 – Present)

- Ohio State Bar Association, Member (1980 – Present)

- Cleveland Metropolitan Bar Association, Member (1980 – Present)

Community Involvement

- Geauga Park District Foundation, Trustee (2000-2006); Secretary (2004 – 2006)

- Troy Township (Geauga County) Board of Zoning Appeals, Member (2006 – 2012, 2024 – Present)

- Chairman (2010 – 2012)

- Geauga County Bluecoats, Inc. (2010 – Present)

- Parkside Church, Member (2000 – Present)

Awards & Honors

- Recognized by Best Lawyers® in the areas of Closely Held Companies and Family Businesses Law, Employee Benefits (ERISA) Law, Tax Law, and Trusts and Estates (2009-Present)

- Recognized on the Ohio Super Lawyers list (2010, 2017 – Present)

- Recognized as Lawyer of the Year in Closely Held Companies and Family Businesses Law in Cleveland by Best Lawyers® (2019)

- Rated as AV Preeminent by Martindale-Hubbell

Publications

- “Transfer restrictions for closely held businesses,” Currents Magazine (November 2021)

- “Ohio’s New LLC Statute Will Become Effective in 2022,” Frantz Ward Client Alert (August 2021)

- “Congress Clarifies the Deductibility of Expenses Paid with Forgiven PPP Loan Proceeds,” Frantz Ward Client Alert (December 2020)

- “Deadline for Rolling Over 2020 RMDs Expires August 31, 2020,” Frantz Ward Client Alert (July 2020)

- “Ohio Income Tax Filing Date Extended to July 15,” Frantz Ward Client Alert (March 2020)

- “The SECURE Act May Have a Material Impact on Your Estate Planning,” Frantz Ward Client Alert (January 2020)

Presentations & Lectures

- “When Closely Held Businesses Are Held Too Closely,” Association of Corporate Counsel, Cleveland, OH (August 2021)

- “Contract Implications in the Age of COVID-19,” Association of Corporate Counsel Webinar (October 2020)

Media Coverage

- Mentioned in, “Lawyers, Firms Receive Recognition,” Cleveland Jewish News (January 2021)